Understand Value Friction

The buyer will not be willing to pay the full value you calculate. That’s partially because they are anchored to different figures.

Every purchase is discounted by risk (of value falling short of expectations), but strategic buyers are also watching another set of figures that will discount the value you can capture.

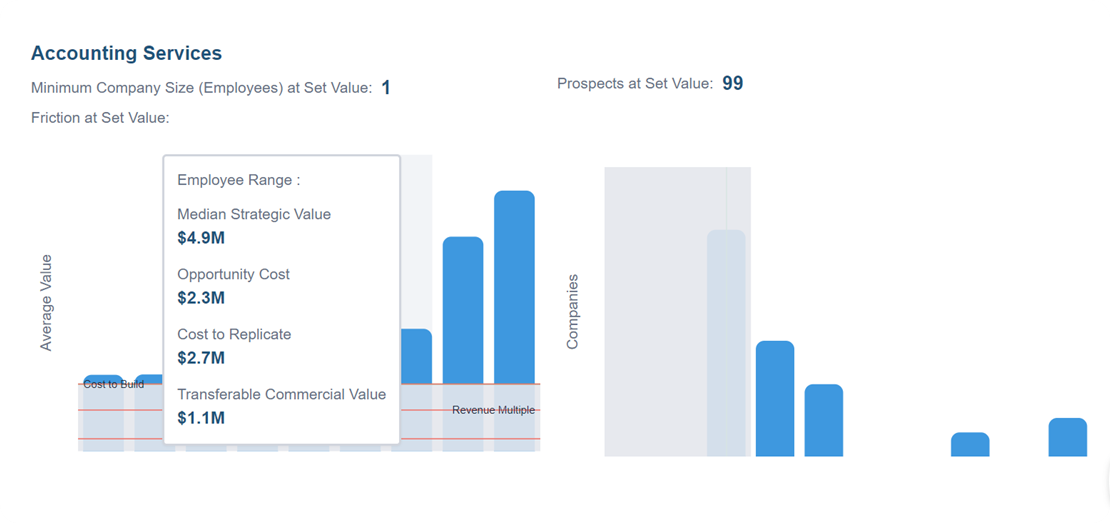

Revenue Multiple

The industry standard revenue multiple for a SaaS company is 3-8x. If you have a company that raised a $2M Seed round, built a sophisticated solution, took it out to market and ran out of money at $10K ARR does that mean the company is worth $30K-$80K? Probably not. But be prepared to answer objections when you float a number that is not inline with industry standard multiples.

Capital Raised

Acquirers know that investors in a company that isn’t going to hit milestones for the next round are happy to get their investment back. So oftentimes, that is where they will start the negotiation.

Cost to Replicate

It’s not uncommon to hear, “My CTO said this would cost us like $200K to build.” Don’t bother digging into that number. What’s important is that the number is missing the opportunity cost during the time spent building. That’s your counter argument.